How to decarbonize your house with the Inflation Reduction Act incentives

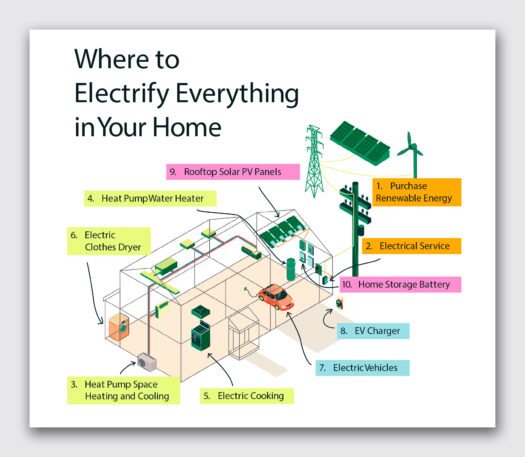

A typical house runs on fossil fuels: Gas or oil powers your furnace and water heater. The stove in your kitchen probably also runs on gas (that is, methane); the direct emissions from all of the gas stoves in the U.S. are equivalent to the pollution from half a million cars as methane leaks out during use and as the appliances sit there. Your clothes dryer might also run on gas. The electricity from your utility company probably still isn’t fully renewable. The car in your garage probably isn’t yet electric. “If you add all of that up—all the decisions we make about energy at our kitchen tables—something like 42% of U.S. energy emissions are tied to those decisions,” says Sam Calisch, one of the founders of Rewiring America, a nonprofit focused on electrification. Systems-level changes obviously also need to happen. But swapping out your old appliances and car for clean alternatives can make a true difference, and the new incentives in the Inflation Reduction Act, the climate bill recently passed into law, can make many of the upfront costs easier to handle. Over time, decarbonizing your house also saves money. Rewiring America estimates that as households electrify, they can save, on average, $1,800 per household per year on energy bills. [Image: Rewiring America]The new climate incentives in the Inflation Reduction Act are “going to be transformative to how the market works,” Calisch says. “We estimate something like $100 billion of those dollars are going to actually directly help consumers make this transition and realize the benefits of of electrification.” One key part of the new law is a set of rebates aimed at low- and moderate-income households. Households making between 80% and 150% of the area median income can get back half of the cost of specific energy upgrades, while those making less than 80% of the median income can be fully rebated, up to a certain cap. The incentives include: Up to $8,000 for a heat pump for heating and cooling Up to $4,000 to upgrade your electrical panel (to prepare for an all-electric home) Up to $2,500 for new wiring Up to $1,750 for a heat pump water heater Up to $1,600 for insulation, air sealing, and ventilation Up to $840 for an electric stove, oven, or an electric heat pump dryer For those who don’t qualify for a complete rebate, upgrades can still be expensive, but the partial rebates can help nudge people to make greener choices when they were already going to replace old equipment. The incentives are upfront discounts and can be combined up to a total of $14,000 per household, since the total funding available has limits. They aren’t available yet, since states will be getting funding to administer programs. But they can be combined with additional federal tax credits that are available now and can be used to reduce your next tax bill. A heat pump, for example, qualifies for a tax credit of up to $2,000, or 30% of the cost of the equipment and installation. A new electrical panel can get a tax credit of up to $600. More expensive equipment, including geothermal heat systems and solar panels, can also get 30% tax credits. Another program, called Hope for Homes, gives as much as an $8,000 rebate when homeowners can show that energy upgrades have improved efficiency by a certain percentage. Some of the incentives are also available to renters, including a 30% tax credit on a subscription to a community solar program. Two other tax credits are available for buying either new or used electric cars. All of the changes don’t have to happen immediately. In a guidebook that walks you through how to electrify your home, Rewiring America suggests starting out by making a note of how old your appliances are, and then making a plan for replacing them with better versions as they wear out. In some cases, that might mean simple steps like adding a new electrical outlet near an appliance so you’re ready when you need to buy an electric replacement. “One thing we’ll see frequently is people get excited, and then they go and start looking at the details of what it’ll take,” Calisch says. “And it can be overwhelming. It’s important to remember not everything has to happen at once. You have time to do this. And what’s really important is just to plan for it.” Another early step is to get a home energy audit to see where you may need to add insulation to stop energy leaks. You’ll also want to buy renewable energy by switching to a new plan through your utility or joining a community solar program. As the cost of wind and solar power have steeply dropped, the grid is already transitioning, but consumers can help push utilities to move faster. (Even while your electricity isn’t completely renewable, switching to electrical appliances like heat pumps is a good idea because they’re much more efficient, and then they’ll be in place as utilities add more and more clean energy.) In many cases, it also makes financial sense to add solar panels to your roof. All of the changes will end

A typical house runs on fossil fuels: Gas or oil powers your furnace and water heater. The stove in your kitchen probably also runs on gas (that is, methane); the direct emissions from all of the gas stoves in the U.S. are equivalent to the pollution from half a million cars as methane leaks out during use and as the appliances sit there. Your clothes dryer might also run on gas. The electricity from your utility company probably still isn’t fully renewable. The car in your garage probably isn’t yet electric.

“If you add all of that up—all the decisions we make about energy at our kitchen tables—something like 42% of U.S. energy emissions are tied to those decisions,” says Sam Calisch, one of the founders of Rewiring America, a nonprofit focused on electrification.

Systems-level changes obviously also need to happen. But swapping out your old appliances and car for clean alternatives can make a true difference, and the new incentives in the Inflation Reduction Act, the climate bill recently passed into law, can make many of the upfront costs easier to handle. Over time, decarbonizing your house also saves money. Rewiring America estimates that as households electrify, they can save, on average, $1,800 per household per year on energy bills.

One key part of the new law is a set of rebates aimed at low- and moderate-income households. Households making between 80% and 150% of the area median income can get back half of the cost of specific energy upgrades, while those making less than 80% of the median income can be fully rebated, up to a certain cap. The incentives include:

- Up to $8,000 for a heat pump for heating and cooling

- Up to $4,000 to upgrade your electrical panel (to prepare for an all-electric home)

- Up to $2,500 for new wiring

- Up to $1,750 for a heat pump water heater

- Up to $1,600 for insulation, air sealing, and ventilation

- Up to $840 for an electric stove, oven, or an electric heat pump dryer

For those who don’t qualify for a complete rebate, upgrades can still be expensive, but the partial rebates can help nudge people to make greener choices when they were already going to replace old equipment. The incentives are upfront discounts and can be combined up to a total of $14,000 per household, since the total funding available has limits. They aren’t available yet, since states will be getting funding to administer programs. But they can be combined with additional federal tax credits that are available now and can be used to reduce your next tax bill.

A heat pump, for example, qualifies for a tax credit of up to $2,000, or 30% of the cost of the equipment and installation. A new electrical panel can get a tax credit of up to $600. More expensive equipment, including geothermal heat systems and solar panels, can also get 30% tax credits. Another program, called Hope for Homes, gives as much as an $8,000 rebate when homeowners can show that energy upgrades have improved efficiency by a certain percentage. Some of the incentives are also available to renters, including a 30% tax credit on a subscription to a community solar program. Two other tax credits are available for buying either new or used electric cars.

All of the changes don’t have to happen immediately. In a guidebook that walks you through how to electrify your home, Rewiring America suggests starting out by making a note of how old your appliances are, and then making a plan for replacing them with better versions as they wear out. In some cases, that might mean simple steps like adding a new electrical outlet near an appliance so you’re ready when you need to buy an electric replacement. “One thing we’ll see frequently is people get excited, and then they go and start looking at the details of what it’ll take,” Calisch says. “And it can be overwhelming. It’s important to remember not everything has to happen at once. You have time to do this. And what’s really important is just to plan for it.”

Another early step is to get a home energy audit to see where you may need to add insulation to stop energy leaks. You’ll also want to buy renewable energy by switching to a new plan through your utility or joining a community solar program. As the cost of wind and solar power have steeply dropped, the grid is already transitioning, but consumers can help push utilities to move faster. (Even while your electricity isn’t completely renewable, switching to electrical appliances like heat pumps is a good idea because they’re much more efficient, and then they’ll be in place as utilities add more and more clean energy.) In many cases, it also makes financial sense to add solar panels to your roof.

All of the changes will end up ultimately saving you money. A new calculator estimates the total incentives you could access through the Inflation Reduction Act, as well as how much you could save on energy costs by making the switch. A couple living in Burlington, Vermont, for example, making $100,000 a year, would be eligible for $21,536 in total incentives and could save an estimated $1,450 on energy bills each year.