Every AI founder thinks they want a mega investing round. Trust me, you don’t

There is a strange gravitational pull in the AI ecosystem right now. Every founder wants to raise a monster round. A $50 million seed. A $200 million Series A. The kind of fundraise that makes headlines, melts your inbox, and gets your parents to finally understand you have a real job.

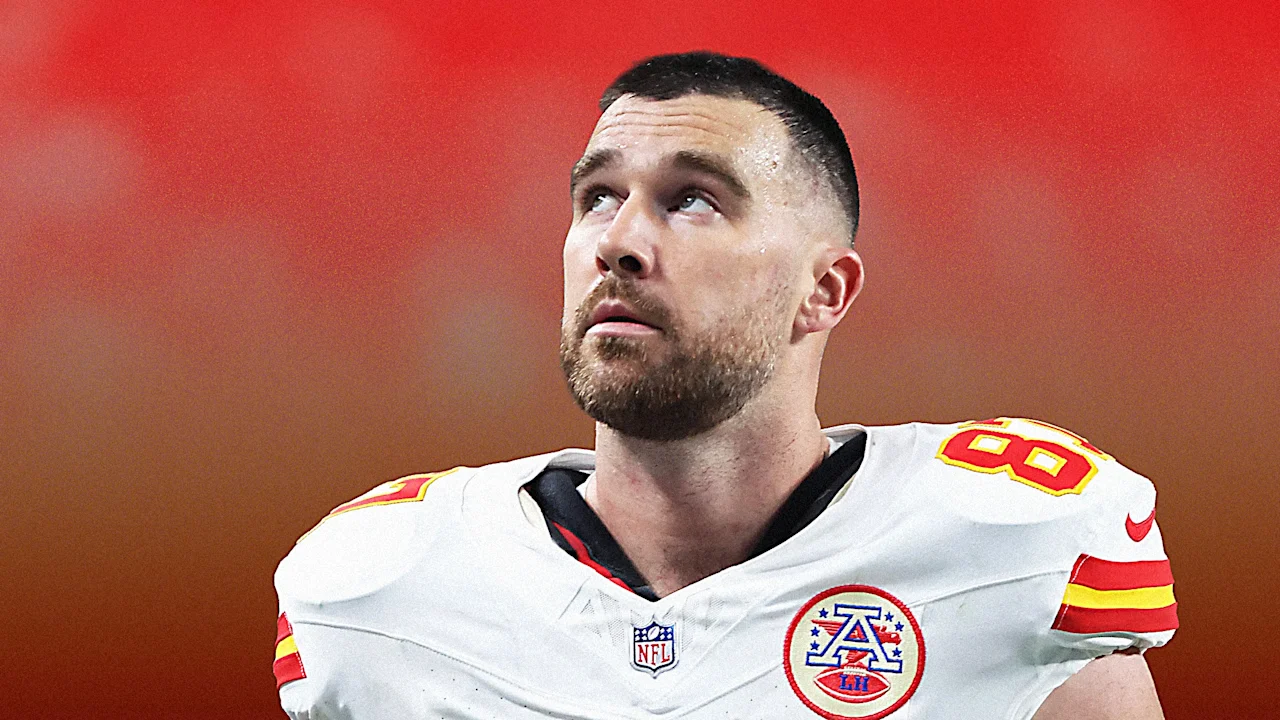

I’ve raised both kinds of rounds. A $12 million one that looked incredible in TechCrunch. And recently, an intentionally small but oversubscribed pre-seed for my new company, Empromptu.ai, where investors fought for allocation like we were handing out Taylor Swift tickets. Having lived on both sides, here is the truth no one in AI land wants to say out loud: A mega round might be the fastest way to screw up your company.

The perfection problem

When I raised $12 million at my last startup, CodeSee.io, I thought I was winning. Fewer than 30 Black women have ever raised that much venture capital. I thought big money meant big validation. And yes, years later, it was validating. CodeSee.io was Cursor before Cursor was cool. But what people forget is that everything had to be perfect. Perfect product, perfect engineering, perfect marketing, perfect sales, perfect timing. You are signing up for perfection with capital that large. And the second you fall short, the clock starts ticking on the next round, your runway, and your team’s morale.

Here is what no one tells you until you are already living inside the pressure cooker.

A mega round is a contract with the future, not a celebration of the present. You are promising you will grow like a weed even while the world is chaos. In AI especially, half the market is noise and the other half is vaporware. You are still finding product-market-something, but your fundraising number tells the world you are already at product-market-fit. Now your job is not to build truth. It is to build momentum.

Markets change, timing changes, and your optimism doesn’t pay your investors back. Big rounds push you toward optics instead of output. You start building for the board instead of the customer. The louder the round, the more deafening the expectations that follow. Before chasing a headline-sized round, you need to ask yourself hard questions:

- Based on your actual GTM engine—not the one you hope to have—how much return can you realistically deliver?

- Do you have the sales pipeline, category dynamics, and team structure to grow 10 times or even 20 times the capital you want to raise?

- If an external shock hits—an economic downturn, an AI bubble burst, or a sudden shift in whatever latest metrics investors care about—does your business have the frameworks and adaptability to survive it and still justify your valuation?

Raising the stakes

Most founders don’t run these numbers honestly. We romanticize optimism. But fundraising is not about what you believe your company could be worth—it’s about whether you have the machinery to make that valuation real in the harshest version of the future. A mega round multiplies every assumption you make. Every risk. Every blind spot.

And ego makes it even harder. Getting told your company is worth $50 million at the idea stage is intoxicating. It’s human nature to want to believe the flattering version of your story. But the best founders know how to put their ego on the shelf long enough to look at their business objectively. Investors don’t care how good the number feels; they care whether you can return their fund.

Most importantly: AI is changing too fast for giant commitments. Today’s hype cycle is tomorrow’s graveyard. You do not want to be the founder forced to keep shipping an outdated strategy because that is what you raised money for. Momentum is a blessing only if you are pointed in the right direction. If you are not, it becomes an anchor.

With Empromptu, we kept the round intentionally small and tight, at least for now. We chose discipline over dopamine. And here is the secret: Small money gives you big freedom. You can pivot. Experiment. Say no. Build weird things. Build the right things. Build your company instead of your investor’s portfolio theory.

Raising less does not mean thinking smaller. It means thinking smarter. You do not need a mega round. You need real progress, real customers, and real clarity.

And if you still want the $100 million round, at least go in with your eyes open. Sometimes the most powerful thing a founder can do is grow at the speed of understanding instead of the speed of capital.