Contentstack raises $80M to grow its headless CMS platform for the enterprise

The market for enterprise content management systems (CMS) is steeply growing as the need to organize and manage documents, images and other forms of digital content increases. According to Allied Market Research, the entire CMS sector combined could be worth $53.2 billion by 2030, up from $21.5 billion in 2020. While the concept of CMS […] Contentstack raises $80M to grow its headless CMS platform for the enterprise by Kyle Wiggers originally published on TechCrunch

The market for enterprise content management systems (CMS) is steeply growing as the need to organize and manage documents, images and other forms of digital content increases. According to Allied Market Research, the entire CMS sector combined could be worth $53.2 billion by 2030, up from $21.5 billion in 2020.

While the concept of CMS has been around for decades, a relatively new innovation — so-called headless CMS — is beginning to attract both market share and the interest of investors. Headless CMS systems act primarily as content repositories, managing back-end infrastructure while affording plenty of customization on the front end. They’re similar to widgets or plug-ins on a website; a headless CMS is usually combined with a separate presentation layer that handles the design and structure elements, templates and the like.

Contentstack is one of several vendors offering a headless CMS geared toward enterprise customers. The company today announced that it raised $80 million in a Series C round co-led by Georgian and Insight Partners, which also saw participation from Illuminate Ventures. Having raised $169 million to date, Contentstack plans to put the funding toward customer acquisition, geographic expansion, new partnerships and product development, CEO Neha Sampat tells TechCrunch.

“Contentstack empowers marketers and developers to deliver composable digital experiences at the speed of their imagination through automated headless CMS technology,” Sampat said via email. “Composable architectures ensure that enterprises can innovate swiftly, deploy new features rapidly, and remain agile in the face of digital disruption. Nobody gets ‘stuck’ with monolithic systems that don’t grow with the business or the world.”

Contentstack, which was founded in 2018, was created on the back of fifteen-year-old consulting firm Raw Engineering and Built.io, an app development platform that Raw Engineering launched in 2013. (Closing the loop, Contentstack eventually bought the CMS division of Raw Engineering in 2018). Sampat — who co-founded Built.io — teamed up with Nishant Patel, the former VP of engineering at Software AG (which ended up acquiring Built.io) and Built.io’s second co-founder, to launch Contentstack.

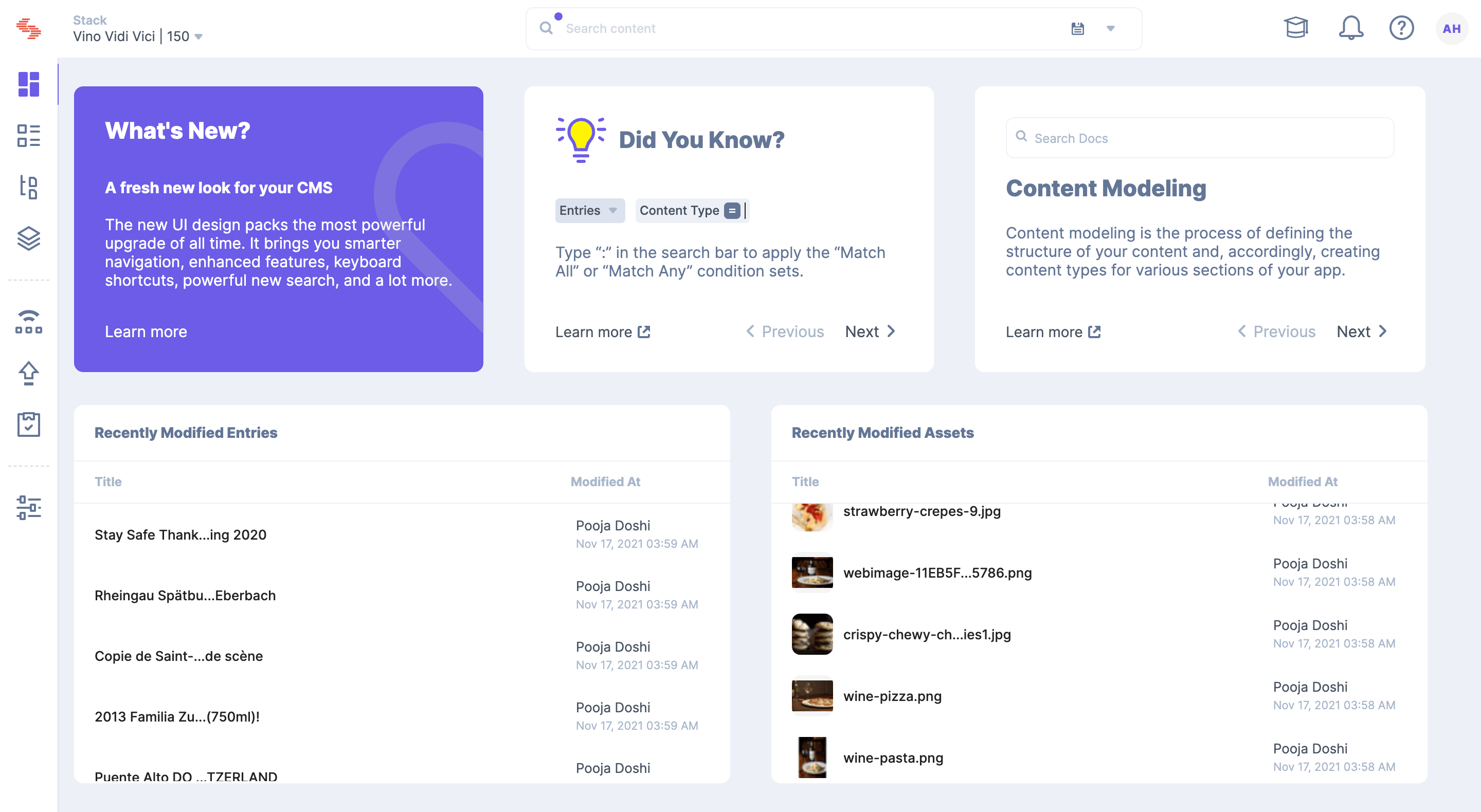

A look at Contentstack’s CMS platform for enterprises, which leans into workflow automation and customization. Image Credits: Contentstack

Contentstack competes with headless CMS vendors, including Storyblok, which raised $47 million in May for its CMS aimed at nontechnical users, and Prismic, which recently raised $20 million to build out its fully managed CMS. (An interesting data point: VCs have invested over $118 million in CMS startups in the last year alone.) Strapi and Kontent are among the startup’s other rivals. But Sampat makes the case that Contentstack is the only CMS offering automation capabilities that don’t require code.

Using the workflows in Contentstack, users can review, approve and publish content across their organization. A marketplace offers a hub for extensions, apps and integrations built by customers, partners and the company’s own engineering team.

“Typically, content management requires a lot of backend development and programming skills. There is a risk that comes with that, for example, the risk of breaking other processes, enduring the cumbersome and lengthy requirements to implement the solution into the tech stack, and a lack of flexibility to change or maintain the flow of content,” Sampat said. “With Contentstack’s composable architecture, enterprises can tailor their martech stack and tools to their unique brand, team and customer experience needs quickly and easily unlocking the full potential of a composable tech stack.”

Is Contentstack’s platform that much easier to use than the competition’s? Perhaps. Data shows, however, that many organizations struggle to use CMS to its full potential regardless of the vendor. In a 2021 survey released by the Content Marketing Institute, 56% of employees said that integration issues stymied their implementation of CMS while 55% blamed a lack of training.

The company, which has more than 400 employees, appears to have won over enterprises regardless, though, with a client base that includes Shell, JPMorgan Chase, HP, McDonald’s and Mattel and several unnamed public sector agencies. The company claims to have doubled its customers since last summer and surpassed 50,000 users on the platform.

“The pandemic and recent economic pressure has generated a major shift in the market, causing enterprises to review the performance of their existing digital investments and shift focus to efficiency. Ultimately, this means enterprises now have a higher standard for the return on investment in digital investments,” Sampat continued. “For digital strategy, having a composable architecture enables the speed to iterate and keep up with the constantly changing conditions and demands. Contentstack is well-positioned to empower these digital leaders to outperform through a ‘value- and success-based’ approach coupled with a proven path to a modern, composable architecture that will scale and adapt for the long term.”

Contentstack raises $80M to grow its headless CMS platform for the enterprise by Kyle Wiggers originally published on TechCrunch