What you should do if Amazon withholds your funds

By Anna Jordan on Small Business UK - Advice and Ideas for UK Small Businesses and SMEs Hundreds of small business sellers have had their funds withheld by Amazon. Here's what to do if it happens to you The post What you should do if Amazon withholds your funds appeared first on Small Business UK.

By Anna Jordan on Small Business UK - Advice and Ideas for UK Small Businesses and SMEs

There could be a number of reasons that Amazon may withhold your funds: suspicion of fraud, suspicious transactions or – in the most recent spate of cases – doing VAT checks.

It was first reported in August 2023 that Amazon was withholding funds from small business sellers due to these checks, leaving many small sellers struggling. The checks are being done to stamp out VAT fraud and follow rules introduced in 2021 which require retailers to collect and send VAT on transactions involving overseas sellers.

Etsy did something similar in 2023, withholding money for its ‘reserve system’ to “keep the marketplace safe”, with some sellers only given hours of notice.

In response to Amazon’s withholding of funds, Enterprise Minister, Kevin Hollinrake, has written a letter to Amazon UK’s chief executive demanding that they unfreeze these sellers’ funds.

Here’s more on the story and what you should do if Amazon withholds your funds. Alternatively, you can head straight to the section that’s of most interest to you.

- What’s happened?

- How is it affecting small business owners?

- How it has affected me: Phil Daley, founder of Simply NikNaks

- What’s being done?

- What can I do if Amazon withholds my funds?

What’s happened?

To stay in line with VAT legislation, Amazon has been performing VAT checks on sellers. Unfortunately, the process for these checks have been littered with difficulties which have put many small business sellers in a vulnerable position.

An Amazon spokesperson said: “To comply with VAT legislation and help combat tax fraud, we recently began a process to perform additional verification of the VAT status of all sellers, in the UK and abroad, that sell on our UK store. While we tried to make this process as smooth as possible, it did not meet the high standards that we hold ourselves to and we apologise to sellers who experienced issues with verification.

“We are taking this situation extremely seriously, committing additional resources to improve and speed up the process. We’ve already verified the majority of sellers, and we are working to verify the remaining sellers as quickly and smoothly as possible.

“We encourage the government to continue to improve the public information available to determine if a seller is UK-based for VAT purposes.”

Small Business asked why checks are being introduced now despite the legislation in question being introduced in 2021. The Amazon spokesperson said: “The checks occurring now are a result of additional due diligence that we are carrying out to verify where sellers are operating their businesses from.”

How is it affecting small business owners?

Small businesses haven’t been able to access any of their funds from Amazon, which could mean the difference between them thriving and folding.

“You will appreciate that most of the sellers on Amazon are small businesses – many of them are sole traders,” said Small Business Commissioner, Liz Barclay. “Now, it seems to me that sellers are even more vulnerable to negative detriment if they don’t get the money they’re expecting. For most of them, they need to pay out to suppliers on a daily basis, they need to produce on a daily basis, they need to get their goods out to the market on a daily basis.

“So, for them not being paid on the day that they expect to have funds that they can then draw down and disburse is detrimental. I think sometimes there’s a lack of understanding of the fact that even a few pounds for a day can really have an impact on a small business.”

Since the VAT checks began, Barclay has received some 400 messages from distressed business owners. A number of them have been waiting for five months to have their funds released, others have been told that their funds have been released when in reality they hadn’t.

“The longer they have been waiting for those funds, the more they are concerned about the viability of their businesses in future,” she told Small Business. “Some of them have had to lay off employees. I had a classic example yesterday morning from a man who said, ‘I can’t afford to pay my staff, I’m going to have to let them go. I can’t pay myself a salary, I can’t pay my wife her salary. My business is, for all to all intents and purposes, bankrupt.’”

The overriding issue that Barclay has been hearing is that these entrepreneurs are all unable to sleep at night, thinking about the impact that this is going to have – which is harming their mental health in turn.

“The irony of this is that a lot of sellers are saying to us, ‘We haven’t been able to pay our tax and VAT bills at the end of January’ because their money has been held by Amazon,” she added.

How it has affected me: Phil Daley, founder of Simply NikNaks

Sole trader Daley spoke to us to recount his experience of having the funds for Simply Nik Naks withheld during these VAT checks.

“I got an email with the words: ‘Indicators of unmet business establishments.’

“It’ll always annoy me that Amazon sent out these important notifications by email with links – which to me is always insecure – in the first place. I went on to the forums, and loads of others had received exactly the same email. So yes, it was a proper email, not a scam.

“They wanted all these documents sending out to prove that I’m a UK business. We’ve set up an account on Amazon, so we’ve done this verification. These are the exact same documents you send them: utility bills, copies of your passport, copies of your driving license. I don’t understand why they now suddenly decided that we’re not a UK business when we sent these [documents] off years ago.

“You follow exactly what it says. I got a reply saying, ‘We cannot verify your documents, please send.’ I thought, ‘Please tell me what was wrong with the documents and answer the question of what documents you would need.’

“Everybody was having the same trouble. Some people have been told they were emailing from their non-registered Amazon email address and others were getting different errors about what documents are needed. You can go through the same process again and can send the documents back and they say they need more, or they need different ones.

“They said they’d accept the driver’s license. In the end, as I sent a scan of a driver’s license, but they wanted a physical photograph. Then they wanted both sides of the driving license. The reverse side only shows what classes of vehicle the holder can drive. They got to the point where they asked me for my PAYE payslips. I said, ‘No, I’m sorry, I’m self-employed. I don’t have any payslips.’ They then asked for a document with my UTR, which is the tax record number.

“It was all back and forth, back and forth, several iterations – I did eventually get through it all. All these documents were sent by non-secure email to goodness knows where. It’s all been sent by an unsecured email that anybody could have hacked into. We didn’t know who had access to it. That’s what I think everybody’s complaining about.

“Eventually, when did they decide that the documents are okay, they still withheld funds for the sales that we were making. It took me about four weeks from end to end. But there were still some people on the forums that haven’t have any money since the end of December. And they’re still waiting [at time of interview].

“They did it at the time when we had VAT bills to pay and income tax bills to pay. I was quite lucky in that I had £1,000 in the Amazon hold. There were some people on the forum saying they couldn’t access tens of thousands of pounds. They couldn’t pay the staff, they couldn’t pay their suppliers, they couldn’t pay their tax bill, all because Amazon were refusing to release funds.

“As soon as they told me they’d verified my documents, and that I could do disbursements, they said that my next payment will be on my next payment cycle. This was on February 2, I think. I checked and my next payment cycle wasn’t until February 16. I couldn’t wait another two weeks. It was also a lot of new funds, so I had to create a case for sales support and say, ‘Look, my documents and my verification are complete. Why can’t I get to my funds?’ They took another two days before I could physically take out the money. But there are people on the forums who have been told, ‘Okay, you can do disbursements’, but they still can’t do it, even weeks later.

“Customer service is non-existent. It’s the worst one that that I’ve dealt with. I sell on eBay and other marketplaces, and Amazon is just awful. I don’t know where their support goes or what training they give to people, but it’s it absolutely abysmal. Often, if you send a message about another problem, they’ll come back to you and ask you something which is not what I was asking about, while asking for things which they’d asked me for in the first place.

Amazon is far too big – and they rely on too much on robots and artificial intelligence where you want to contact a human who can understand your problems. The problem is that they have so many rules and regulations. They don’t even follow their own rules and regulations. All these policies which we have to adhere to. When you make a slight mistake they lay the hammer into you, but when you say, ‘You haven’t followed policy’, that doesn’t matter.

“I’m probably one of the lucky ones as it’s only myself. I don’t have staff to pay. What’s more ridiculous is that Amazon were threatening that if you didn’t go through this process within 60 days, or emails within 30 days (you didn’t know which one it was), they were going to backdate that automatically, backdate it all the way to January 2021, back-paying HMRC with what they calculate the VAT should have been. I’ve paid all my VAT, so if Amazon then use that money to pay it again, how do I claim that back? It’s not money that is actually owed.

“The VAT rules came into effect in January 2021. That makes Amazon the deemed supplier for VAT purposes. So, what Amazon should be doing is collecting the VAT on the sale and sending it to HMRC themselves. Nowhere does it say that the seller is responsible. Then for them to now suddenly say, ‘Oh, we’ve got all these checks, because UK businesses pay VAT’. Why didn’t Amazon do all this verification at the end of 2020?“

Related: ‘We’d been wiped off the face of the internet’ – what to do if you lose your domain – Pedram Mershahi, co-founder of Kloris CBD, talks about the struggle of having his domain suspended – find out what to do if you lose your domain

What’s being done?

Though we’ve passed the worst of the crisis, Amazon is still taking steps to release funds for sellers. However, the progress was slow to get going.

“I have no remit over Amazon. I shouldn’t be meddling in this at all, frankly. But because nobody else is, and the department and I are working together to talk to Amazon. That’s where we come in,” said Liz Barclay.

“Amazon is saying, ‘This is legislation, we need to comply with the legislation. We need to verify ourselves for VAT and we need to do that properly and we need to make sure that we are not allowing any fraudulent sellers to operate on our platform.’ The sellers are saying, ‘We get that, but the question remains: Why shut down the sellers and make it impossible for them to carry on trading while the verification checks are being carried out?’”

She added that Amazon does recognise that processes have been slow, leaving small businesses at risk.

At the beginning, the Small Business Commissioner was talking to Amazon because she was personally receiving a deluge emails as someone had suggested on one of the forums that it would be a good idea to talk to the Small Business Commissioner.

They were coming through to her and she sent them on to Amazon. Unable to cope with the volume of emails – they don’t have the staff at that capacity – Amazon agreed that if the Small Business Commissioner’s office were to send those emails with the details of the account and the email address to Amazon, the giant would prioritise the checking of those businesses. “However, I had to go back to the sellers to get their consent to do that,” said Barclay. “Not all of them gave their consent, because some of them felt that there might be retribution against them. If they were to be seen to have been complaining to a third party, which is always the case with small businesses, there is always that fear.”

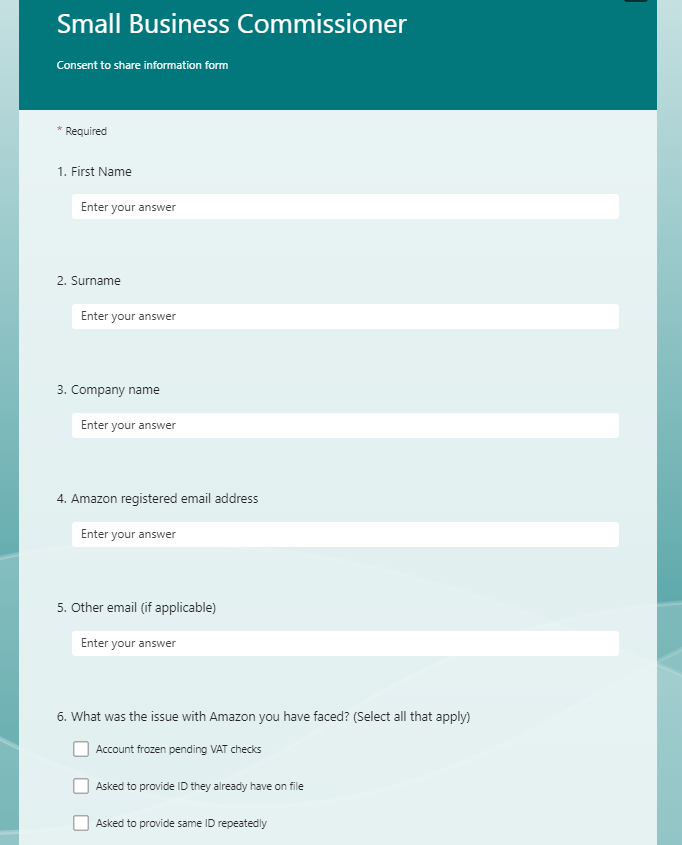

To deal with the flow of emails, the Department for Business and Trade came up with a form that would automatically fill across to a spreadsheet to Amazon. “We’ve been asking people who contact us in the first instance to fill in that form. Their details would go to Amazon, Amazon then would prioritise the checks,” said Barclay.

“The problem beyond that is that we are now getting sellers who filled in the form saying they are verified, but their funds are still on hold. And so that seems to be where the difficulty sits at the moment. And I’m not really able to do much about that except keep saying to Amazon, ‘We’ve had however many today of these people in these situations,’” said Barclay.

If you’re experiencing issues, you can fill out the form here, even if your issue isn’t related to VAT checks.

The form looks a little something like this:

What can I do if Amazon withholds my funds?

As we’re sure many small business sellers will be asking: ‘How can I prevent this happening to me in future?”

Sadly, there’s only so much that a small business can do, especially with the power that Amazon wields. “It’s entirely up to a big company like Amazon, how they conduct their business and how they interpret their compliance with pieces of legislation,” said Barclay. “But I would say that I do think communication has broken down in a lot of cases. I really would like to see better notification that these events, where funds might be held, are likely to come up so that sellers are better prepared, better informed, and that they can take steps to safeguard things.”

We come back to Daley once again to find out what he’s doing in future: “I’m going to be requesting my funds virtually on a daily basis now. I was only requesting it every two weeks before.”

Is this experience enough for him to consider focusing on other selling platforms? “I have to say, I would ditch Amazon altogether if I could,” said Daley. “The trouble is that everybody nowadays goes to Amazon to buy. You’re stuck in that. I sell on eBay and I’ve got my own website. I’ve got multiple outlets. Still, 80 per cent of my sales come from Amazon. I can’t just turn around to them and say, ‘I’ve had it with you now’.

There is cause for optimism as the situation calms down. “Things are tailing off,” said Barclay. “It’s not anywhere near as many people contacting me as were contacting me. It would seem that Amazon is beginning to get underneath it.”

Read more

The pros and cons of selling through your own website – One of the most important decisions you have to make as an online seller is where you should do your selling. One entrepreneur explains why she uses her own website rather than eBay and other major selling platforms

What is the VAT threshold? – At what point does your small business have to start paying VAT? Should you voluntarily pay VAT? And what are legitimate ways to stay under the VAT threshold?

Sole traders increasingly avoid charging VAT – Tens of thousands of small businesses deliberately stay small to avoid charging VAT, which means you have to hike prices if you wander over the £85,000 threshold

The post What you should do if Amazon withholds your funds appeared first on Small Business UK.