The ‘Echo Housing Boom’ is here

Want more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter. Last week, Wyoming Gov. Mark Gordon signed four bills that will reduce property taxes for Wyoming homeowners. “I am happy to sign this package of legislation, which provides targeted relief to taxpayers most impacted by increasing valuations while ensuring our counties and schools are able to continue to provide the services our residents rely on,” Gov. Gordon said in a press release. Wyoming has seen the largest jump in median property taxes paid since the pre-pandemic period. According to CoreLogic data, between 2019 and 2023, the median annual property taxes paid for single-family homes increased by 41% for Wyoming homeowners. During the same period, Wyoming home prices, as tracked by Zillow, rose by 32.5%. But here’s the thing: Wyoming is an outlier. Over the past four years, national home prices have risen 40.8% while national property taxes paid have risen 21.6%. Home price growth outpaced property tax growth in 47 of 50 states between 2019 and 2023. Only three states, including Wyoming, have seen the opposite. The fact that property taxes haven’t caught up to home price growth that occurred during the pandemic housing boom suggests that higher property tax bills await homeowners in most states. The same is also true for home insurance rates. These lingering property tax hikes and home insurance hikes are what ResiClub has coined the “Echo Housing Boom.” To see what’s happening to property taxes across the country, ResiClub reached out to CoreLogic, which provided data on the median amount homeowners paid in property taxes for single-family homes by state from 2019 to 2023. Before we dive into the state-level data, it’s important to note that property tax policy varies significantly by state, and even down to the local municipality level. Some states pass it on to homeowners faster. Other states have rules that make increases a slow drip. Click here to view an interactive version of the map below. Homeowners in these five states saw the biggest surges in property taxes paid from 2019 to 2023: Wyoming: +41.0%Florida: +34.9%Indiana: +34.7%Georgia: +34.0%Kansas: +33.0% These five states’ property taxes paid increased the least from 2019 to 2023: Michigan: -4.3% (CoreLogic isn’t sure why Michigan is down)Idaho -1.0%Delaware: +3.4%Maine: +5.8%Vermont: +5.9% Click here to view an interactive version of the chart below. Generally speaking, homeowners with fixed mortgages are buffered from the negative financial impacts of spiked house prices and mortgage rates. Of course, it’s a different story for property tax and home insurance payments. “While homeowners benefit from higher home prices and gains in homeowners’ equity, they are also experiencing a rising burden from higher property tax payment,” CoreLogic economist Yanling Mayer tells ResiClub. Mayer added: “In general, one would normally expect states with persistent and fast appreciating home prices to experience the fastest increases in property taxes, assuming property tax rates have stayed relatively unchanged… But this is not always true, especially when there are state laws which limit how much property assessment can go up in a given assessment cycle.” Click here to view an interactive version of the chart below. California homes are renowned for their exorbitant prices, with numerous cities in the state ranking among the most expensive places to live in the U.S. Furthermore, metropolitan areas in California such as San Diego, Riverside, and Santa Maria experienced home price increases of 45% or more over the past 4 years. Despite seeing some of the steepest home price surges, California evaded the very top of the list for states with the largest shifts in median property tax payments. This, of course, is due to Proposition 13. Adopted in 1978, Proposition 13 does three main things for California homeowners: Limits the annual real estate tax to 1% of the property’s assessed value Requires properties to be assessed at market value at the time of saleProhibits assessments from rising by more than 2% per year “Proposition 13 has shielded homeowners from upside shocks to home prices,” CoreLogic’s Mayer told ResiClub. “In addition, Proposition 13’s acquisition-based assessment method means that many homeowners in California are paying rather modest amounts of property taxes.” Officials in other states are also facing political pressure to slow down the increases. Wyoming’s four new property tax laws will temper the increasing tax burden for homeowners, mostly through exemptions. Idaho, which saw a surge in interstate migration during the pandemic, passed a tax relief bill in 2023 to cut property taxes by an average of 18% across the state. Since 2019, the median amount of property taxes a homeowner is paying in Idaho has decreased by 1%.

Want more stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the free, daily ResiClub newsletter.

Last week, Wyoming Gov. Mark Gordon signed four bills that will reduce property taxes for Wyoming homeowners.

“I am happy to sign this package of legislation, which provides targeted relief to taxpayers most impacted by increasing valuations while ensuring our counties and schools are able to continue to provide the services our residents rely on,” Gov. Gordon said in a press release.

Wyoming has seen the largest jump in median property taxes paid since the pre-pandemic period. According to CoreLogic data, between 2019 and 2023, the median annual property taxes paid for single-family homes increased by 41% for Wyoming homeowners. During the same period, Wyoming home prices, as tracked by Zillow, rose by 32.5%.

But here’s the thing: Wyoming is an outlier.

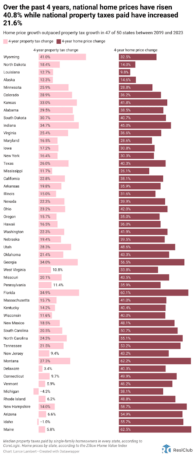

Over the past four years, national home prices have risen 40.8% while national property taxes paid have risen 21.6%. Home price growth outpaced property tax growth in 47 of 50 states between 2019 and 2023. Only three states, including Wyoming, have seen the opposite.

The fact that property taxes haven’t caught up to home price growth that occurred during the pandemic housing boom suggests that higher property tax bills await homeowners in most states. The same is also true for home insurance rates. These lingering property tax hikes and home insurance hikes are what ResiClub has coined the “Echo Housing Boom.”

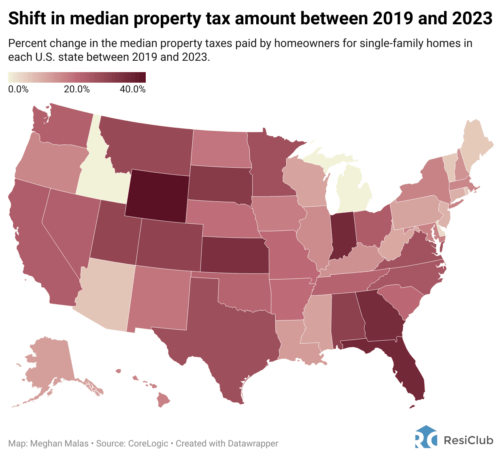

To see what’s happening to property taxes across the country, ResiClub reached out to CoreLogic, which provided data on the median amount homeowners paid in property taxes for single-family homes by state from 2019 to 2023.

Before we dive into the state-level data, it’s important to note that property tax policy varies significantly by state, and even down to the local municipality level. Some states pass it on to homeowners faster. Other states have rules that make increases a slow drip.

Click here to view an interactive version of the map below.

Homeowners in these five states saw the biggest surges in property taxes paid from 2019 to 2023:

- Wyoming: +41.0%

- Florida: +34.9%

- Indiana: +34.7%

- Georgia: +34.0%

- Kansas: +33.0%

These five states’ property taxes paid increased the least from 2019 to 2023:

- Michigan: -4.3% (CoreLogic isn’t sure why Michigan is down)

- Idaho -1.0%

- Delaware: +3.4%

- Maine: +5.8%

- Vermont: +5.9%

Click here to view an interactive version of the chart below.

Generally speaking, homeowners with fixed mortgages are buffered from the negative financial impacts of spiked house prices and mortgage rates. Of course, it’s a different story for property tax and home insurance payments.

“While homeowners benefit from higher home prices and gains in homeowners’ equity, they are also experiencing a rising burden from higher property tax payment,” CoreLogic economist Yanling Mayer tells ResiClub.

Mayer added: “In general, one would normally expect states with persistent and fast appreciating home prices to experience the fastest increases in property taxes, assuming property tax rates have stayed relatively unchanged… But this is not always true, especially when there are state laws which limit how much property assessment can go up in a given assessment cycle.”

Click here to view an interactive version of the chart below.

California homes are renowned for their exorbitant prices, with numerous cities in the state ranking among the most expensive places to live in the U.S. Furthermore, metropolitan areas in California such as San Diego, Riverside, and Santa Maria experienced home price increases of 45% or more over the past 4 years.

Despite seeing some of the steepest home price surges, California evaded the very top of the list for states with the largest shifts in median property tax payments. This, of course, is due to Proposition 13.

Adopted in 1978, Proposition 13 does three main things for California homeowners:

- Limits the annual real estate tax to 1% of the property’s assessed value

- Requires properties to be assessed at market value at the time of sale

- Prohibits assessments from rising by more than 2% per year

“Proposition 13 has shielded homeowners from upside shocks to home prices,” CoreLogic’s Mayer told ResiClub. “In addition, Proposition 13’s acquisition-based assessment method means that many homeowners in California are paying rather modest amounts of property taxes.”

Officials in other states are also facing political pressure to slow down the increases. Wyoming’s four new property tax laws will temper the increasing tax burden for homeowners, mostly through exemptions. Idaho, which saw a surge in interstate migration during the pandemic, passed a tax relief bill in 2023 to cut property taxes by an average of 18% across the state. Since 2019, the median amount of property taxes a homeowner is paying in Idaho has decreased by 1%.