Shifting housing market: Where home prices are falling right now

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. Most housing markets across the country are softening. As strained affordability suppresses housing demand, and homes sit on the market longer, active inventory in most housing markets is rising year-over-year. We’re also starting to see a softening in home price growth in more markets. According to the Zillow Home Value Index, U.S. home prices fell 0.03% month-over-month between July 2024 and August 2024. From a historical perspective, that is fairly soft for this time of year. Historically speaking, July to August has averaged a 0.4% month-over-month increase since 2000. This aggregated national housing market softening is regionally concentrated. Some regional housing markets in states such as Texas, Florida, Arizona, and Louisiana, where inventory has risen above pre-pandemic 2019 levels, are experiencing mild home price corrections. During the seasonally strong spring period, many of these markets in correction mode were showing very low or flat price increases. However, now that we’re past the seasonally strong period, some of those Southwest and Southeast markets are beginning to post outright month-over-month declines. Meanwhile, tight resale markets in places like Southern California, the Northeast, and the Midwest—where prices are still up a solid amount year-over-year—appear to be nearly done posting gains for the 2024 calendar year. Markets that experience a negative month-over-month decline between the seasonally stronger July-to-August window usually see further declines from September to December. As month-over-month U.S. home price growth is softening, so is national year-over-year home price growth. According to the Zillow Home Value Index, U.S. home prices are up 2.5% year-over-year between August 2023 and August 2024. Back in March 2024, that year-over-year national home price growth rate was 4.6%. Why are home prices softening the most around the Gulf, according to regional home price data? Many of these Southeast and Southwest experienced even greater home price growth during the pandemic housing boom, which stretched fundamentals too far beyond local incomes. Once pandemic-fueled migration slowed, and rates spiked, it became an issue in places like Austin and Tampa. Unlike many Sun Belt housing markets, many Northeast and Midwest markets have lower levels of homebuilding. As new supply becomes available in Southwest and Southeast markets, and builders use affordability adjustments like mortgage rate buydowns to move it, it has created a cooling effect in the resale market. The Northeast and Midwest don’t have that same level of new supply, so resale/existing homes are pretty much the only game in town. In the Sunshine State, there's an additional cooling factor: Florida's condo market is dealing with the aftereffects of regulations passed following the Surfside condo collapse in 2021.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

Most housing markets across the country are softening. As strained affordability suppresses housing demand, and homes sit on the market longer, active inventory in most housing markets is rising year-over-year.

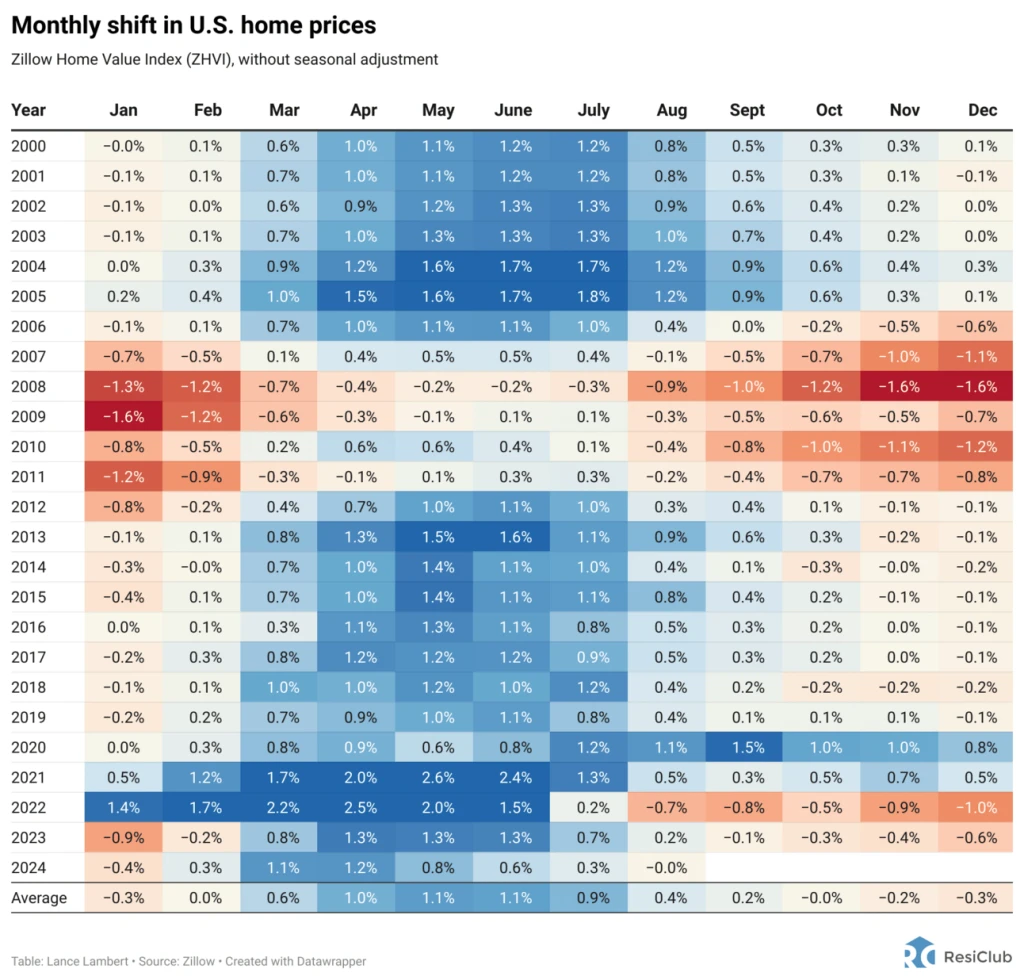

We’re also starting to see a softening in home price growth in more markets. According to the Zillow Home Value Index, U.S. home prices fell 0.03% month-over-month between July 2024 and August 2024. From a historical perspective, that is fairly soft for this time of year. Historically speaking, July to August has averaged a 0.4% month-over-month increase since 2000.

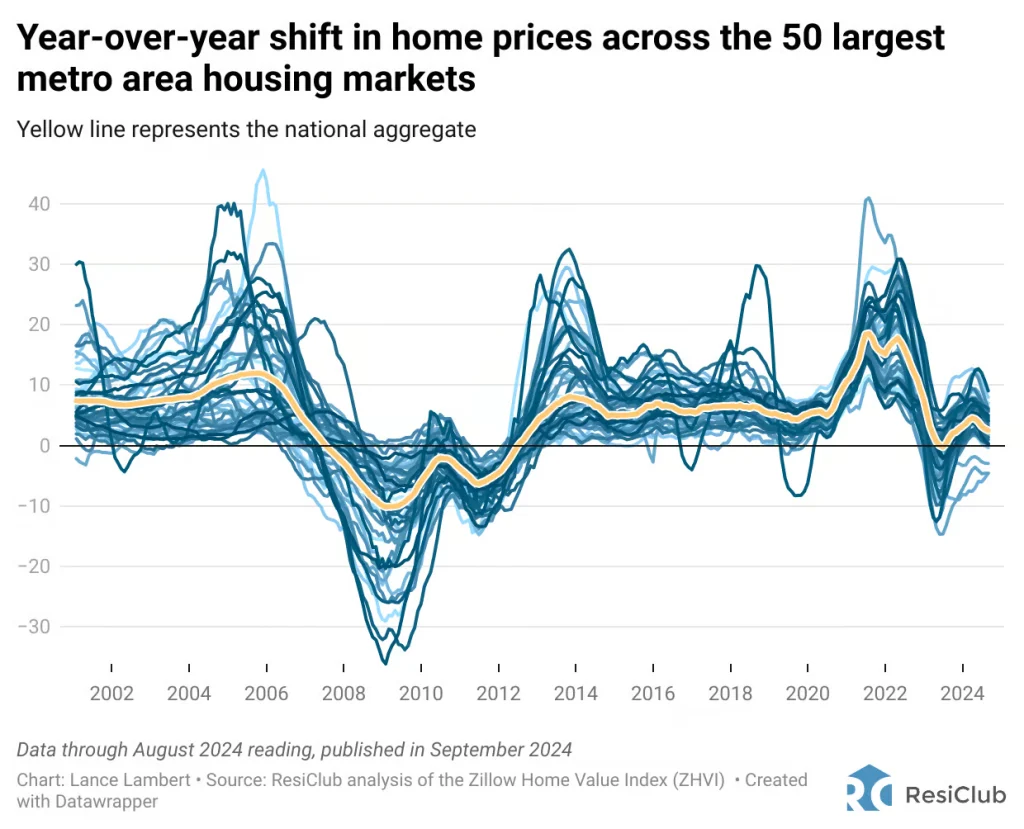

This aggregated national housing market softening is regionally concentrated.

Some regional housing markets in states such as Texas, Florida, Arizona, and Louisiana, where inventory has risen above pre-pandemic 2019 levels, are experiencing mild home price corrections. During the seasonally strong spring period, many of these markets in correction mode were showing very low or flat price increases. However, now that we’re past the seasonally strong period, some of those Southwest and Southeast markets are beginning to post outright month-over-month declines. Meanwhile, tight resale markets in places like Southern California, the Northeast, and the Midwest—where prices are still up a solid amount year-over-year—appear to be nearly done posting gains for the 2024 calendar year.

Markets that experience a negative month-over-month decline between the seasonally stronger July-to-August window usually see further declines from September to December.

As month-over-month U.S. home price growth is softening, so is national year-over-year home price growth.

According to the Zillow Home Value Index, U.S. home prices are up 2.5% year-over-year between August 2023 and August 2024. Back in March 2024, that year-over-year national home price growth rate was 4.6%.

Why are home prices softening the most around the Gulf, according to regional home price data?

Many of these Southeast and Southwest experienced even greater home price growth during the pandemic housing boom, which stretched fundamentals too far beyond local incomes. Once pandemic-fueled migration slowed, and rates spiked, it became an issue in places like Austin and Tampa.

Unlike many Sun Belt housing markets, many Northeast and Midwest markets have lower levels of homebuilding. As new supply becomes available in Southwest and Southeast markets, and builders use affordability adjustments like mortgage rate buydowns to move it, it has created a cooling effect in the resale market. The Northeast and Midwest don’t have that same level of new supply, so resale/existing homes are pretty much the only game in town.

In the Sunshine State, there's an additional cooling factor: Florida's condo market is dealing with the aftereffects of regulations passed following the Surfside condo collapse in 2021.