Onramp Funds accelerates e-commerce financing platform with $42M in equity, credit

The company provides working capital based on sales forecast data to resolve the shipping, fulfillment, advertising and inventory cost of goods for e-commerce sellers.

Onramp Funds, an Austin-based company providing financing to e-commerce sellers, secured $42 million in equity and credit to expand its working capital offering.

CEO Eric Youngstrom founded the company in 2020 after a career at multicarrier shipping software company ShippingEasy. One of the problems with shipping at that time, back in 2012, was that you would have to log into each individual marketplace. For example, Amazon, eBay or Shopify, to see orders and figure out how to process them. What ShippingEasy did was bring that all together under one data management platform.

When ShippingEasy was acquired by Stamps.com in 2016, Youngstrom shifted over to the new company and saw a new problem emerge — that smaller e-commerce merchants couldn’t afford to ship an order because their credit cards were maxed out.

“People just didn’t have the money necessary to complete the order,” he told TechCrunch. “The money’s there — in three days it’ll be deposited into your account, but if you don’t get it going today, you’re going to lose the order. Amazon set the standard there.”

Youngstrom and his team tried solving the problem inside of Stamps.com, but couldn’t find a good solution, so he decided to leave in 2020 and launch a product that could help merchants.

The solution Onramp Funds came up with was a data-driven technology. The company doesn’t just look at top-line sales, which Youngstrom believes differentiates his company from competitors but takes in historical sales data to build a sales forecast.

Onramp then provides working capital from that data to resolve the shipping, fulfillment, advertising and inventory cost of goods so that merchants can take their own capital and redeploy it into their growing business. The company makes its revenue by charging a percentage of the sales, typically around 1%.

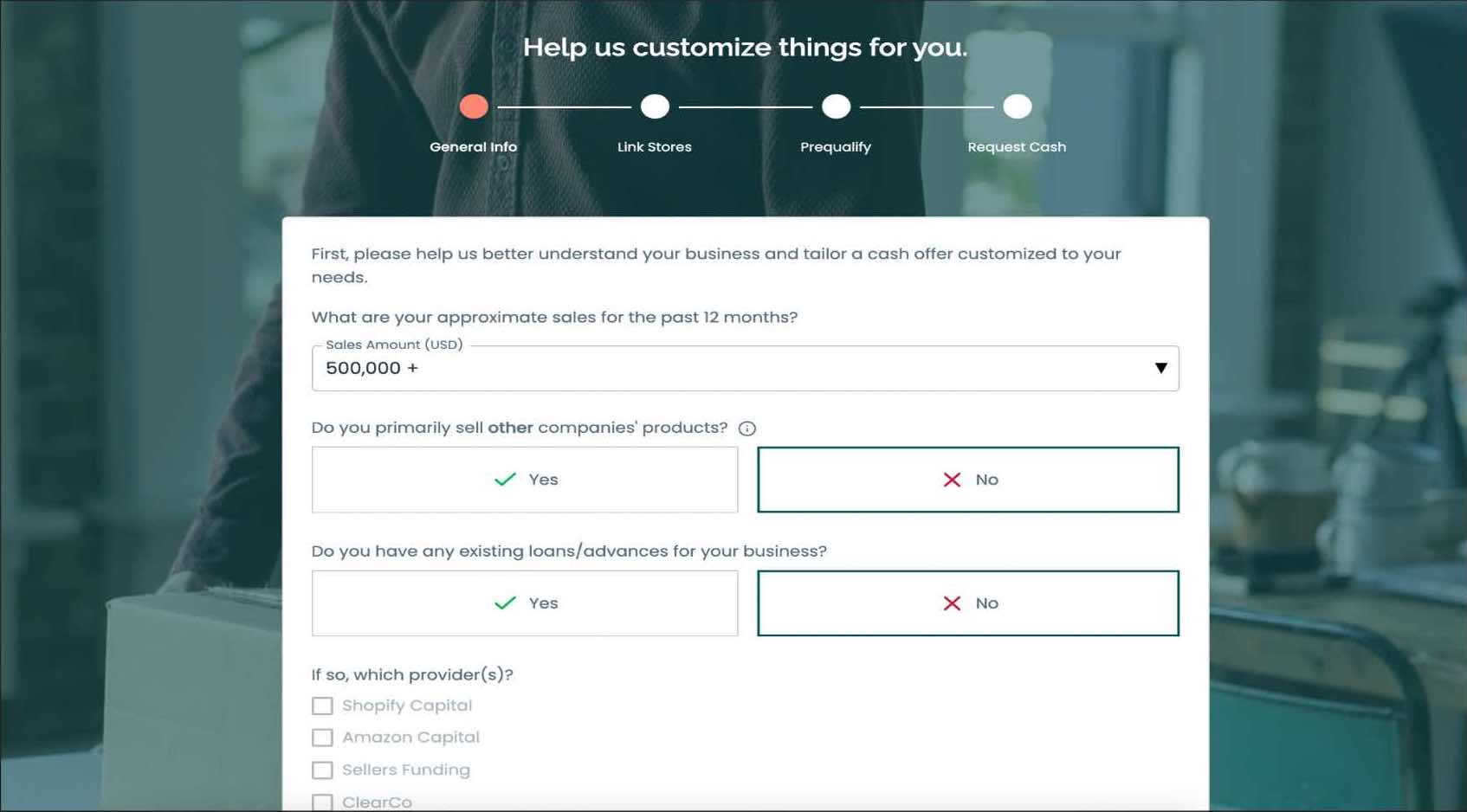

Onramp Funds web platform. Image Credits: Onramp Funds

Providing working capital to small businesses is somewhat of a personal mission for Youngstrom, who grew up around business owners in a small town and related to the need to support local businesses. He also notes e-commerce sales in the U.S. are still under 20% of all retail sales, so there is over 80% of retail still ripe for e-commerce to grab more market share.

“If we can help the small business owner, we can make the world a better place,” he added. “If we get to help people succeed at their jobs, I think that’s wonderful.”

Meanwhile, Youngstrom declined to provide the breakdown on the $42 million equity versus credit line ratio. Luther King Capital Management led the funding, which also included a group of high-net-worth individuals.

Since officially launching the working capital offering nine months ago, Onramp is now working with hundreds of customers, some of whom have used the service multiple times. Revenue is growing 30% month over month.

While the credit line will be used for financing small businesses, the equity portion will go to build out Onramp’s customer acquisition engine and bring in additional staff in the areas of engineering, product, sales, marketing and client success. The company currently has 27 employees.

The company is also providing more guidance to merchants when it comes to navigating the supply chain bottleneck that got worse during the global pandemic.

“We’re building a really cool business that’s finding great success and very early standards, and we plan to be here for the long haul to help these guys,” Youngstrom added.