Amazon faces a class action lawsuit for putting ads on Prime Video

Amazon’s decision to add commercials to Prime Video has resulted in a potential class action suit, which accuses the company of deceptive practices. The lawsuit, filed last week in federal court in California, says that the introduction of those ads and the requirement of a $2.99 monthly payment to bypass them is a breach of contract and a violation of the state’s consumer protection laws. Existing users, the suit says, signed up for a service that was ad-free—and Amazon’s pivot changed the terms of that agreement. “For years, people purchased and renewed their Amazon Prime subscriptions believing that they would include ad-free streaming,” the complaint reads. “Subscribers must now pay extra to get something they already paid for.” While Disney, Netflix, and Max all offer ad-based subscription levels as well, Amazon did not introduce its ad-supported version as a lower-priced option for subscribers. Instead, the company opted to begin including ads in the base subscription model and then charging a premium to customers who wanted to skip them. “Consumers who subscribed to Amazon Prime before the change reasonably expected that their Amazon Prime subscription would include ad-free streaming of movies and TV shows for the duration of the subscription,” the suit reads. An Amazon spokesperson told Fast Company they were unable to comment on pending litigation. Beyond class action status, the suit is seeking an injunction that would prohibit Amazon from charging existing Prime subscribers an extra amount each month to avoid advertising, as well as restitution to those who have already paid. Alexys Coronel, head of U.S. entertainment and telecommunications for Amazon Ads, said earlier this year that the launch of ads will reach 115 million unique viewers in the U.S., with even more seeing them globally. While streaming services initially lured customers with the promise of commercial-free television shows and movies, Amazon and the other streaming services have all entered a new phase of the streaming revolution—one that’s focused on profitability. Every over-the-top service has invested hundreds of millions, if not billions, of dollars in new programming. Now executives (and investors) have decided it’s time to recoup those investments, which has led to a rash of higher subscription fees and ad-supported plans. Amazon, for instance, saw its content spending last year increase 14% to $18.9 billion. (That number includes both video and music expenses.) Amazon CEO Andy Jassey said on an earnings call last month that the introduction of ads as a default option would allow the company “to continue investing meaningfully in content over time.” Ads or no, Amazon has high expectations for its Prime Video streaming service. “We have increasing conviction that Prime Video can be a large and profitable business on its own, and we’ll continue to invest in compelling exclusive content for Prime members like ‘Thursday Night Football,’ Lord of the Rings, Reacher, Mr. & Mr. Smith, Citadel, and more,” Jassy said last month. Analysts say the financial potential of commercials (as well as charging users to skip those ads) is significant. Morgan Stanley predicts Prime Video ads will generate $3.3 billion in revenue this year alone. And by 2026, that amount should spike to $7.1 billion.

Amazon’s decision to add commercials to Prime Video has resulted in a potential class action suit, which accuses the company of deceptive practices.

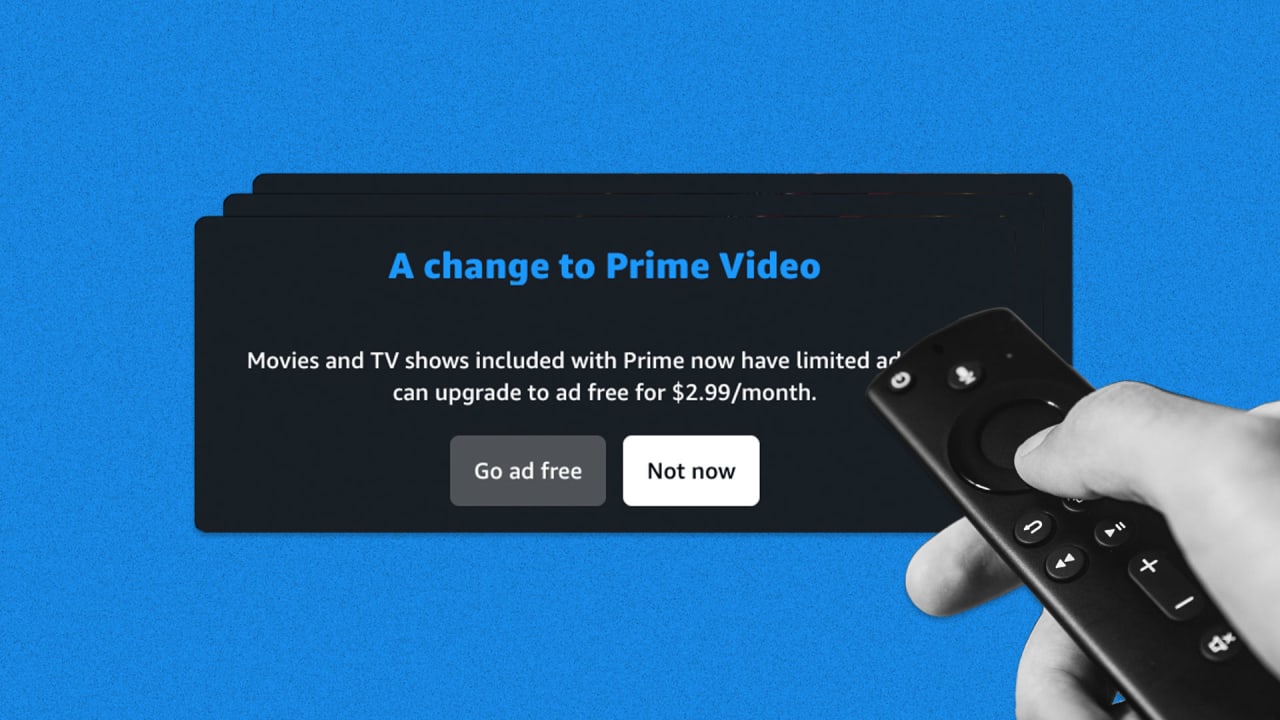

The lawsuit, filed last week in federal court in California, says that the introduction of those ads and the requirement of a $2.99 monthly payment to bypass them is a breach of contract and a violation of the state’s consumer protection laws. Existing users, the suit says, signed up for a service that was ad-free—and Amazon’s pivot changed the terms of that agreement.

“For years, people purchased and renewed their Amazon Prime subscriptions believing that they would include ad-free streaming,” the complaint reads. “Subscribers must now pay extra to get something they already paid for.”

While Disney, Netflix, and Max all offer ad-based subscription levels as well, Amazon did not introduce its ad-supported version as a lower-priced option for subscribers. Instead, the company opted to begin including ads in the base subscription model and then charging a premium to customers who wanted to skip them.

“Consumers who subscribed to Amazon Prime before the change reasonably expected that their Amazon Prime subscription would include ad-free streaming of movies and TV shows for the duration of the subscription,” the suit reads.

An Amazon spokesperson told Fast Company they were unable to comment on pending litigation.

Beyond class action status, the suit is seeking an injunction that would prohibit Amazon from charging existing Prime subscribers an extra amount each month to avoid advertising, as well as restitution to those who have already paid. Alexys Coronel, head of U.S. entertainment and telecommunications for Amazon Ads, said earlier this year that the launch of ads will reach 115 million unique viewers in the U.S., with even more seeing them globally.

While streaming services initially lured customers with the promise of commercial-free television shows and movies, Amazon and the other streaming services have all entered a new phase of the streaming revolution—one that’s focused on profitability.

Every over-the-top service has invested hundreds of millions, if not billions, of dollars in new programming. Now executives (and investors) have decided it’s time to recoup those investments, which has led to a rash of higher subscription fees and ad-supported plans.

Amazon, for instance, saw its content spending last year increase 14% to $18.9 billion. (That number includes both video and music expenses.)

Amazon CEO Andy Jassey said on an earnings call last month that the introduction of ads as a default option would allow the company “to continue investing meaningfully in content over time.”

Ads or no, Amazon has high expectations for its Prime Video streaming service.

“We have increasing conviction that Prime Video can be a large and profitable business on its own, and we’ll continue to invest in compelling exclusive content for Prime members like ‘Thursday Night Football,’ Lord of the Rings, Reacher, Mr. & Mr. Smith, Citadel, and more,” Jassy said last month.

Analysts say the financial potential of commercials (as well as charging users to skip those ads) is significant. Morgan Stanley predicts Prime Video ads will generate $3.3 billion in revenue this year alone. And by 2026, that amount should spike to $7.1 billion.