10 states where housing market inventory just spiked back

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter. As housing markets across the U.S. continue to stabilize from the frenzied highs of the pandemic housing boom, active listings and inventory levels have become critical indicators of market health. ResiClub tracks these metrics closely, as they offer insights into the balance of supply and demand—and what that balance might mean for future home prices. Over the past two years, a clear trend has emerged: Housing markets where active inventory has returned to pre-pandemic levels often experience softer home price growth or outright price declines. In contrast, markets where inventory remains significantly below pre-pandemic levels have generally sustained stronger price growth. Nationally, active listings increased by 26.2% between November 2023 and November 2024, signaling a shift toward more leverage for buyers in many areas. However, active inventory remains 16.6% below November 2019 levels, and some regions continue to experience tight supply—though not uniformly across the country. To see how the story varies across the nation, ResiClub analyzed full-month November inventory data, which was published last week by Realtor.com. Here’s how this November’s total inventory/active listings compares to previous years, according to data from Realtor.com: November 2017: 1,228,077 November 2018: 1,273,047 November 2019: 1,143,332 November 2020: 683,822 November 2021: 512,241 November 2022: 750,200 November 2023: 755,489 November 2024: 953,452 Florida has seen one of the biggest inventory jumps. In Florida, the biggest inventory increases initially over the past two years were concentrated in sections of Southwest Florida. In particular, in markets like Cape Coral, Punta Gorda, and Fort Myers, which were hard-hit by Hurricane Ian in September 2022. This combination of increased housing supply for sale—the damaged homes coming up for sale—coupled with strained demand—the result of spiked home prices, spiked mortgage rates, higher insurance premiums, and higher HOAs—translated into market softening across much of Southwest Florida. However, the inventory increases in Florida now expands far beyond SWFL. Markets like Jacksonville and Orlando are also above pre-pandemic levels, as are many coastal pockets along Florida’s Atlantic Ocean side. One reason for this is that Florida’s condo market is dealing with the after effects of regulation passed following the Surfside condo collapse in 2021. This is compounded by a slowdown in work-from-home migration to Florida and significant home insurance shocks. In August 2024, only 4 states had returned to or surpassed pre-pandemic 2019 active inventory levels. In September 2024, it grew to 7 states. In October 2024, that number grew to 8 states. In November 2024, that number grew again to 10 states: Arizona, Colorado, Florida, Idaho, Oklahoma, Oregon, Tennessee, Texas, Utah, and Washington. States likely to join that list soon include Alabama, Nebraska, Hawaii, and Georgia. Why are Sun Belt and Mountain West markets seeing a faster return to pre-pandemic inventory levels than many Midwest and Northeast markets? One factor is that some pockets of the Sun Belt and Mountain West experienced even greater home price growth during the pandemic housing boom, which stretched fundamentals too far beyond local incomes. Once pandemic-fueled migration slowed, and rates spiked, it became an issue in places like Colorado Springs and Austin. Unlike many Sun Belt housing markets, many Northeast and Midwest markets have lower levels of homebuilding. As new supply becomes available in Southwest and Southeast markets, and builders use affordability adjustments like mortgage rate buydowns to move it, it has created a cooling effect in the resale market. The Northeast and Midwest don’t have that same level of new supply, so resale/existing homes are pretty much the only game in town. Bottom line: This year, we've witnessed a cooling in many housing markets as affordability challenges have dampened the intense demand seen during the pandemic housing boom. While some areas around the Gulf are experiencing declining home prices, most regional housing markets are still recording positive year-over-year price growth. The key question moving forward is whether rising active inventory and months of supply will lead to broader price declines across more markets.

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.

As housing markets across the U.S. continue to stabilize from the frenzied highs of the pandemic housing boom, active listings and inventory levels have become critical indicators of market health. ResiClub tracks these metrics closely, as they offer insights into the balance of supply and demand—and what that balance might mean for future home prices.

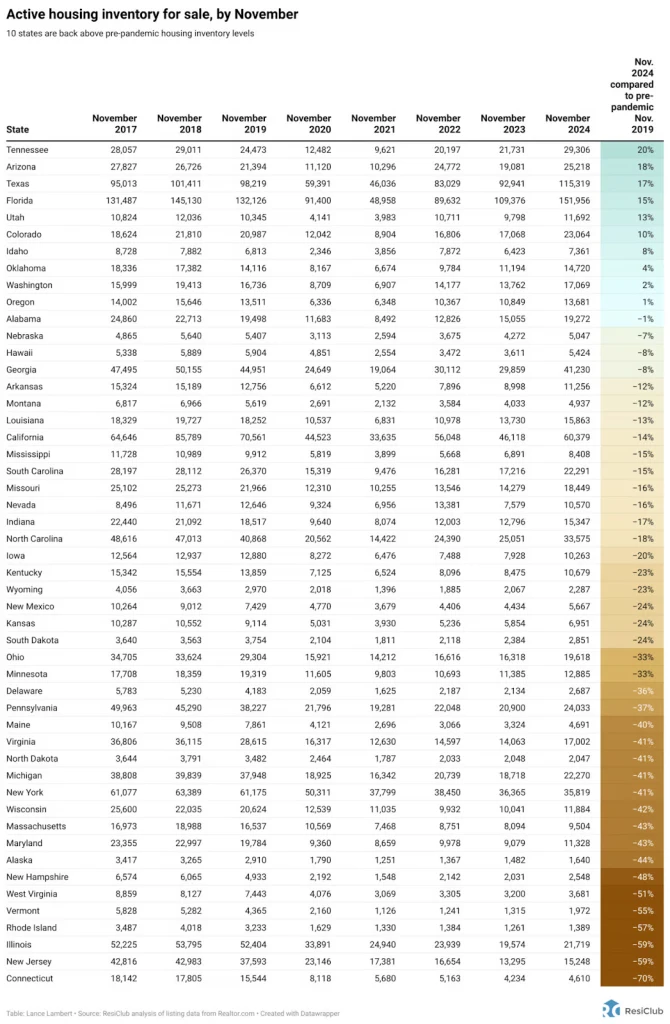

Over the past two years, a clear trend has emerged: Housing markets where active inventory has returned to pre-pandemic levels often experience softer home price growth or outright price declines. In contrast, markets where inventory remains significantly below pre-pandemic levels have generally sustained stronger price growth. Nationally, active listings increased by 26.2% between November 2023 and November 2024, signaling a shift toward more leverage for buyers in many areas. However, active inventory remains 16.6% below November 2019 levels, and some regions continue to experience tight supply—though not uniformly across the country.

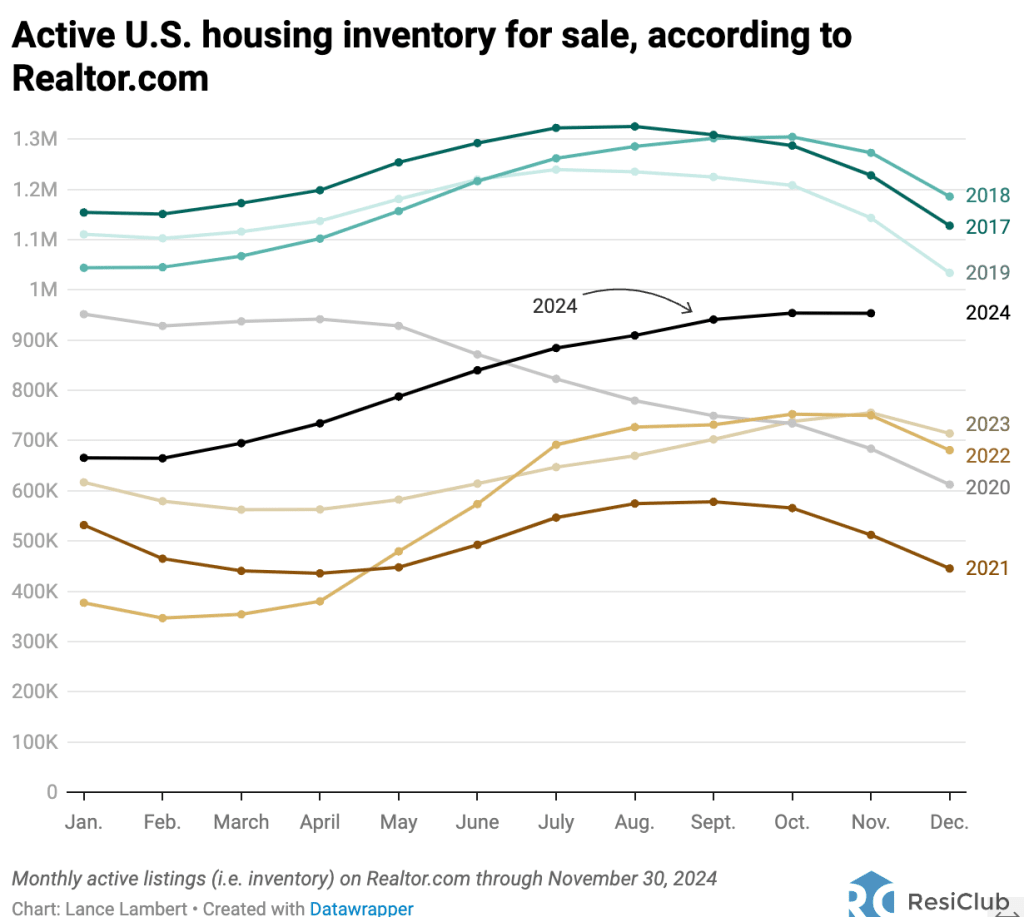

To see how the story varies across the nation, ResiClub analyzed full-month November inventory data, which was published last week by Realtor.com.

Here’s how this November’s total inventory/active listings compares to previous years, according to data from Realtor.com:

November 2017: 1,228,077

November 2018: 1,273,047

November 2019: 1,143,332

November 2020: 683,822

November 2021: 512,241

November 2022: 750,200

November 2023: 755,489

November 2024: 953,452

Florida has seen one of the biggest inventory jumps.

In Florida, the biggest inventory increases initially over the past two years were concentrated in sections of Southwest Florida. In particular, in markets like Cape Coral, Punta Gorda, and Fort Myers, which were hard-hit by Hurricane Ian in September 2022. This combination of increased housing supply for sale—the damaged homes coming up for sale—coupled with strained demand—the result of spiked home prices, spiked mortgage rates, higher insurance premiums, and higher HOAs—translated into market softening across much of Southwest Florida.

However, the inventory increases in Florida now expands far beyond SWFL. Markets like Jacksonville and Orlando are also above pre-pandemic levels, as are many coastal pockets along Florida’s Atlantic Ocean side.

One reason for this is that Florida’s condo market is dealing with the after effects of regulation passed following the Surfside condo collapse in 2021. This is compounded by a slowdown in work-from-home migration to Florida and significant home insurance shocks.

In August 2024, only 4 states had returned to or surpassed pre-pandemic 2019 active inventory levels. In September 2024, it grew to 7 states.

In October 2024, that number grew to 8 states.

In November 2024, that number grew again to 10 states: Arizona, Colorado, Florida, Idaho, Oklahoma, Oregon, Tennessee, Texas, Utah, and Washington.

States likely to join that list soon include Alabama, Nebraska, Hawaii, and Georgia.

Why are Sun Belt and Mountain West markets seeing a faster return to pre-pandemic inventory levels than many Midwest and Northeast markets?

One factor is that some pockets of the Sun Belt and Mountain West experienced even greater home price growth during the pandemic housing boom, which stretched fundamentals too far beyond local incomes. Once pandemic-fueled migration slowed, and rates spiked, it became an issue in places like Colorado Springs and Austin.

Unlike many Sun Belt housing markets, many Northeast and Midwest markets have lower levels of homebuilding. As new supply becomes available in Southwest and Southeast markets, and builders use affordability adjustments like mortgage rate buydowns to move it, it has created a cooling effect in the resale market. The Northeast and Midwest don’t have that same level of new supply, so resale/existing homes are pretty much the only game in town.

Bottom line: This year, we've witnessed a cooling in many housing markets as affordability challenges have dampened the intense demand seen during the pandemic housing boom. While some areas around the Gulf are experiencing declining home prices, most regional housing markets are still recording positive year-over-year price growth. The key question moving forward is whether rising active inventory and months of supply will lead to broader price declines across more markets.